- What is a 529 Plan? - A 529 plan is a tax-advantaged investment plan designed to help families to save for a beneficiary’s (typically one’s child or grandchild) future higher education expenses. While commonly referred to as 529 plans, they are formally known as “Qualified Tuition Programs,” as defined in Section 529 of the Internal Revenue Code and are administered by state agencies and organizations. Source: collegesavings.org

- Some states offer matching grants and other benefits to participants in their 529 plans.

- Check your state for the plan offerings provided. In Colorado, a CollegeInvest 529 Scholarship is designed to award scholarships to Colorado residents of middle income families who have planned for a higher education by saving with a CollegeInvest 529 College Savings Plan. Source: College Invest

- Who can own the plan? Anyone 18 years or older can be an account owner. An account owner can be a parent, grandparent, anyone who designates a beneficiary to receive the benefit or yourself. Gifting strategies should be considered which can help remove assets from your taxable estate. There are no income or age limits on contributions. The account owner retains control of the assets, so they can be used to benefit other family members (or any beneficiary) if the current child (beneficiary) does not use them. The account owner can transfer the balance (or any amount) to any other qualified family (beneficiary) member.

- You can participate in almost any 529 plan across the country, no matter what state you live in.

- Minimum contributions can be as little as $10.

- What’s the tax implication? Investments grow tax deferred. Tax-free withdrawals when used for qualified education expenses. The earnings are state and federal tax-free when used for qualifying expenses. The 529 plan contribution qualifies for the $15,000 per beneficiary annual gift tax exclusion ($30,000 for a married couple

- In some States, the contribution is a state tax deduction (Colorado is one).

- Is it only for College tuition? Funds can be used for tuition and fees, room and board, books, required supplies and equipment, computers or peripheral equipment, computer software or Internet access and related services. Other acceptable expenses include payments for special needs beneficiaries at any accredited school, including public or private universities, graduate schools, community colleges, accredited vocational technical schools, some foreign schools and some K-12 private schools (some states are still voting on whether this selection is tax-deductible).

- Does investing in a 529 plan impact financial aid eligibility? While each educational institution may treat assets held in a 529 account differently, investing in a 529 plan will generally impact a student’s eligibility to receive need-based financial aid. For many families, the larger part of a financial aid package may be in loans. So, the more you can save before college, the less debt you or your student may have to incur during college.

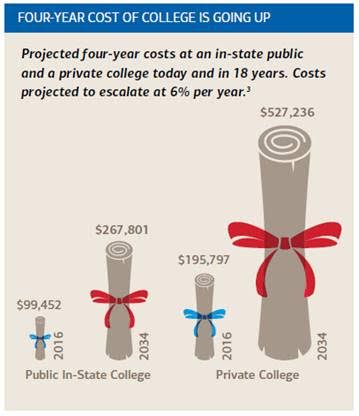

Start investing for college as early as possible. It’s never too early, or too late, to begin. Look at this chart which shows the rising cost of college.

Source: collegeboard.com, College Cost Calculator. The calculation assumes cost one year from February 2016

If you would like to discuss using a 529 Plan for your family, contact Hope Tuck (303.938.3914) at Merrill Lynch today!